The Promise of a Brighter Future

Going to college and earning a degree has always represented the promise of a better life. This is especially the case for poor families and first generation college students.

Rising Cost of Paying for College

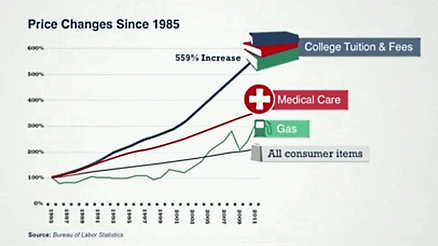

It is becoming more difficult to pay for college, due to the rising costs of colleges around the country. With the economy being slow to recover over the past few years, most people have not seen a raise at work in quite a few years. However, college costs are continuing to grow at a rate far outpacing inflation. In 2013, the average tuition for a public four-year institution was almost $9,000, and the average tuition for a private four-year institution was just over $30,000.

Middle Class Especially Feeling the Pain

As is often the case when it comes to ways to pay for college, the middle class is feeling most of the pain. Many middle class families make a bit too much to qualify for need based grants, but do not make enough to pay cash for college. These families must work extremely hard to find ways to pay for college.

What are Options for Paying for College?

When looking for ways to pay for college, traditional options are still available. If you are struggling when it comes to paying for college, you still have the option of applying for scholarships, federal grants and as a last resort, student loans.

Scholarships

There are literally thousands of scholarships available from all types of organizations, and they are actually not that hard to find. When it comes to paying for college, you should attempt to find as many scholarships as possible and apply to them to attempt to reduce your college costs. You should be able to get a scholarship to receive cash for college for good grades, athletics, being a member of a religious organization, and even for just being left handed.

Because of the large number of scholarships, there are tons of people looking to scam people who are looking for ways to pay for college. Do not let anyone charge you to help find grants or scholarships. With all of the free resources online, you should not need to pay someone to help you find money for college.

Federal Grants

Federal grants are often need based as opposed to scholarships which are merit based. If you come from a poor or even middle class family, you may qualify for a variety of federal grants. If you do not finish school, you may have to actually pay back a portion of your grant.

The US Department of Education provides a variety of different federal grants to help receive money for college. These grant programs are listed below:

- Teacher Education Assistance for College and Higher Education – TEACH Grants

- Federal Supplemental Educational Opportunity Grants (FSEOG)

- Federal Pell Grants

- Iraq and Afghanistan Service Grants

Almost all federal grants are given to students who need help paying for college. If you are interested in applying for grants, you should submit a FAFSA (Free Application for Federal Student Aid) form. Once you have done this you can work with your school or university to find out how much money for college you can receive through federal grants.

Student Loans

Student loans should be a last resort when it comes to obtaining cash for college. There are two different types of student loans, one being less attractive than the other.

- Subsidized loans – For subsidized loans, the US Department of Education actually pays the interest on your loans while you are in school. After you finish college or stop going, you are responsible for paying these loans back. These loans are typically available to students based on financial need.

- Unsubsidized loans – These loans are available with no requirement to have any sort of financial need. Your school determines the amount you can borrow based on the cost of college as well as any other financial aid that you have received. You are responsible for paying all interest on an unsubsidized loan. If you do not pay the interest while you are in school, it will continue to build and you will have to pay it after you finish college.

Loans should only be a solution for a small amount of financial aid. If you have to take out a large amount of student loans, you will likely be paying for college for quite some time. Try to exhaust all other options before resorting to student loans.

Alternative Ways to Pay for College

If you are looking for ways to pay for college and have struck out when it comes to scholarships and grants, you still do have options.

- Part time job – A part time job can be a great way to help offset some of your college costs. Even if you have to take fewer college courses each semester, having a job can help you avoid going into debt when paying for college.

- 2 Year Colleges – Another way to drastically reduce the amount of money that it takes to pay for college is through enrolling in a 2 year community college. Two year colleges cost a fraction of a normal 4 year college and you can save significant money by graduating from a 2 year college and then transferring to a 4 year college for your final 2 years.

Take Aways

Paying for college does not have to cause you to stress out. With the myriad of options available, you should be able to find assistance when paying for college. If you are just starting to apply for college, it is important to begin looking for financial aid options to help figure out ways to pay for college. You should spend just as much time applying for financial aid and scholarships as you do applying for college. With the large number of scholarships available, you should have no trouble finding some type of cash for college.

About the Author

Johnny Rogers is the creator of CollegeTidbits.com – The Online College Planning Guide. If you found this article useful, please consider Liking My Facebook Fan Page or Following College Tidbits on Twitter.

Also Worth Reading

Paying for College – What are the Options?

Buyer Beware: Overcoming College Tuition Sticker Shock!

Paying For Your Child’s College Education

The Myth of the Successful College Dropout

Was this Useful for You?

If so, subscribe to our mailing list and get regular updates from us!

Thank you for subscribing.

Something went wrong.